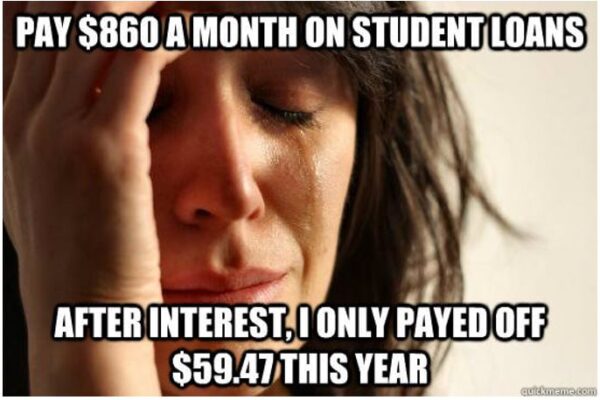

The other day I was scrolling through Facebook when I came across a meme that made me want to laugh and cry at the same time:

Writer’s note: I take full accountability for my choices. I knew I would have student loans after I graduated. I chose to go to college and I also chose one that was a private school so, yes, cue the world’s smallest violin as I speak about my student loans.

At one point in my post-grad career, I had to temporarily switch to an Income-Sensitive Repayment Plan. This option stipulated that the loan payments were going to be based on my annual income. I was only on this plan for about one year but I was paying almost $200 less than what my regular payments were supposed to be. After interest, I had only $70 going toward the principal amount – hence, my tears looking at that meme. Eventually, I got back on track to a regular repayment plan but there was still that burning question inside of me: Why are student loan interest rates so high and how can one possibly get past them?!

You would think that because higher education is seen as an incredibly valuable asset, along with recent graduates not having amassed a significant amount of wealth, student loans would be some of the lowest interest rates around, right?! In a lot of instances, that just isn’t the case. A main component of this is that student loans, like unsecured loans, are not linked to a tangible asset that can be used as collateral. Because you cannot take back someone’s degree if they don’t repay their loans, there is greater risk for a lender. As a result, rates are generally higher than when compared to a secured loan rate.

I understand this thought process, however, it doesn’t solve the issue that I face. How am I supposed to pay down my loan if I can barely get past the interest? After doing some research, I’ve found some helpful tips and tricks on how to lower the interest rate on both federal and private student loans:

Think of refinancing as a trade. When you refinance, you trade in your existing loans for a new private loan, ideally with a lower interest rate. Your new lender pays off your old lenders and you make payments to the new lender going forward. There are some qualifications:

While refinancing is your best bet, many Federal loans and private lenders offer a 0.25% interest rate discount when you sign up to have payments automatically deducted from your bank account. The best thing you can do is contact your loan servicer to find out if the discount is available! An added bonus – you won’t accidentally miss a payment!

It may sound redundant but a high credit score gives you a solid foundation to help you reach your financial goals. Particularly with private lenders, the higher your credit score, the lower the interest rate will be. Keep in mind, Federal Loans don’t require a credit check so rates won’t be affected by credit scores.

If you’re struggling to establish credit, it’s okay! Consider adding a parent or relative, who has a more established record, as a co-signer. Adding a co-signer with good credit improves your overall credit picture and may help you score a lower rate.

I think the 45 million U.S. borrowers who are in a whopping $1.7 trillion worth of debt would agree with my opinion that student loans are just the worst. And while lowering interest rates is not the end-all be-all solution to combating student loans – it does help. Be savvy with your money and do your research so that you can make informed decisions about which student loan option is right for you.

As an MVCU member, you have access to free resources that can help you with your college-related financial decisions! From early research in high school all the way through graduate loans and refinancing later down the road. Student Choice provides financial aid, grant, and loan information.